Corporate Officer’s Inability to Cash Bonus Check Trips Up Entity’s Tax Deduction

A corporation officer’s handling of his year-end bonus check was a case of form over substance, the US Tax Court ruled, and that meant that the bonus payment was not eligible for a tax deduction for payments to corporate officers. The central problem was that the officer clearly did not have unrestricted control over his bonus payment, since the corporation did not had enough money in its bank account to cover the amount of the check.

A corporation officer’s handling of his year-end bonus check was a case of form over substance, the US Tax Court ruled, and that meant that the bonus payment was not eligible for a tax deduction for payments to corporate officers. The central problem was that the officer clearly did not have unrestricted control over his bonus payment, since the corporation did not had enough money in its bank account to cover the amount of the check.

The dispute involved the corporate entity created by architect Robert Vanney. Vanney created Vanney Associates, Inc., a personal services C corporation, in 1987. Vanney was the corporation’s sole shareholder, CEO, and CFO. The entity paid the architect a salary and also paid each of its employees a year-end bonus based upon the business’ profits that year. In 2008, the corporation paid Vanney $240,000 in wages, along with a year-end bonus of $815,000. The after-tax amount of the architect’s bonus was $464,000, but the corporation only had $288,000 in its account at that time. Vanney ultimately loaned his bonus payment to the corporation, which it repaid the next year. The corporation, on its 2008 federal income tax return, claimed a deduction in the amount of $1.055 million for compensation of officers. The Internal Revenue Service issued the corporation a notice of deficiency, having disallowed a portion of the deduction equal to Vanney’s bonus ($815,000).

The corporation took the case to the Tax Court, but to no avail. The court explained that payments by check require special analysis because they are conditional payments. Specifically, if a payee (in this case, the architect) declines to cash a payment by check because he knows that the payor (in this case, the corporation) lacks sufficient funds to cover the amount of the check, that payment is not eligible for the deduction. The payee must have unresticted use of the funds paid to him as a bonus. Furthermore, if the officer and the corporation are related entities, the transaction receives even closer scrutiny. The payment only qualifies for the deduction if it “would have followed the same form if the parties were unrelated.”

The bonus payment to Vanney did not meet these standards. The architect did not have the option of going to the bank and cashing the check for the full $464,000, for the corporation’s account had insufficient funds. In other words, the architect had only restricted use of his bonus. Vanney’s choice — to loan the bonus back to the corporation — was his only option. Clearly, if Vanney and the corporation were not related, his handling of his bonus check likely would not “have followed the same form” as it did. As a result, the bonus was not entitled to the deduction.

While tax planning, particularly planning on behalf of corporations, can provide many substantial benefits in terms of enhanced deductions and lessened tax obligations, it is important to ensure that the techniques you use place substance over style, in order to ensure that they are permissible. For outstanding advice regarding your business entity’s tax planning needs, talk to the skilled tax attorneys at Samuel C. Berger, P.C. and CPAs at S.C. Berger, P.C. Their years of experience can help you create a plan that passes legal muster while assisting your bottom line. To consult our attorneys and CPAs, contact us online or call (201) 587-1500 or (212) 380-8117.

More Blog Posts & Articles:

Corporate Recordkeeping for Small Business Owners, New York & New Jersey Business Lawyer Blog, Sept. 15, 2014

Failed Cemetery Site Tax Shelter Leads to $187K Deficiency Assessment a Decade Later for Investors

Rental Business’ Failure to Commence Dooms Business Expense Deduction

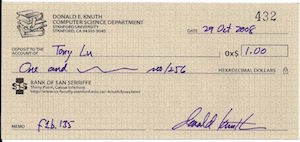

Photo credit: Tltstc at Wikimedia Commons.

Hackensack, New Jersey Tax Deduction Attorney Samuel C Berger, PC Home

Hackensack, New Jersey Tax Deduction Attorney Samuel C Berger, PC Home